When it comes to buying a car at the dealership, most people get intimidated. The sales pitch, the push to buy, and then there's trying to understand the price. The toughest part is when it comes to negotiating that price you see on the window sticker, that's if you can negotiate at all, which some dealerships no longer even engage in. Many dealerships stopped during the pandemic when prices jumped due to supply chain delays. But the market is mellowing out, so it's not the same as it was just a year ago.

If you go into the dealership with some good tips on how best to negotiate (and not get intimidated by seasoned salespeople), you can be well-armed to do what needs to be done. But first, you need to understand what that sticker price is all about and figure out where to go from there in order to get the best possible price that also fits your budget. But first, you need to understand what's involved.

What is a Sticker Price?

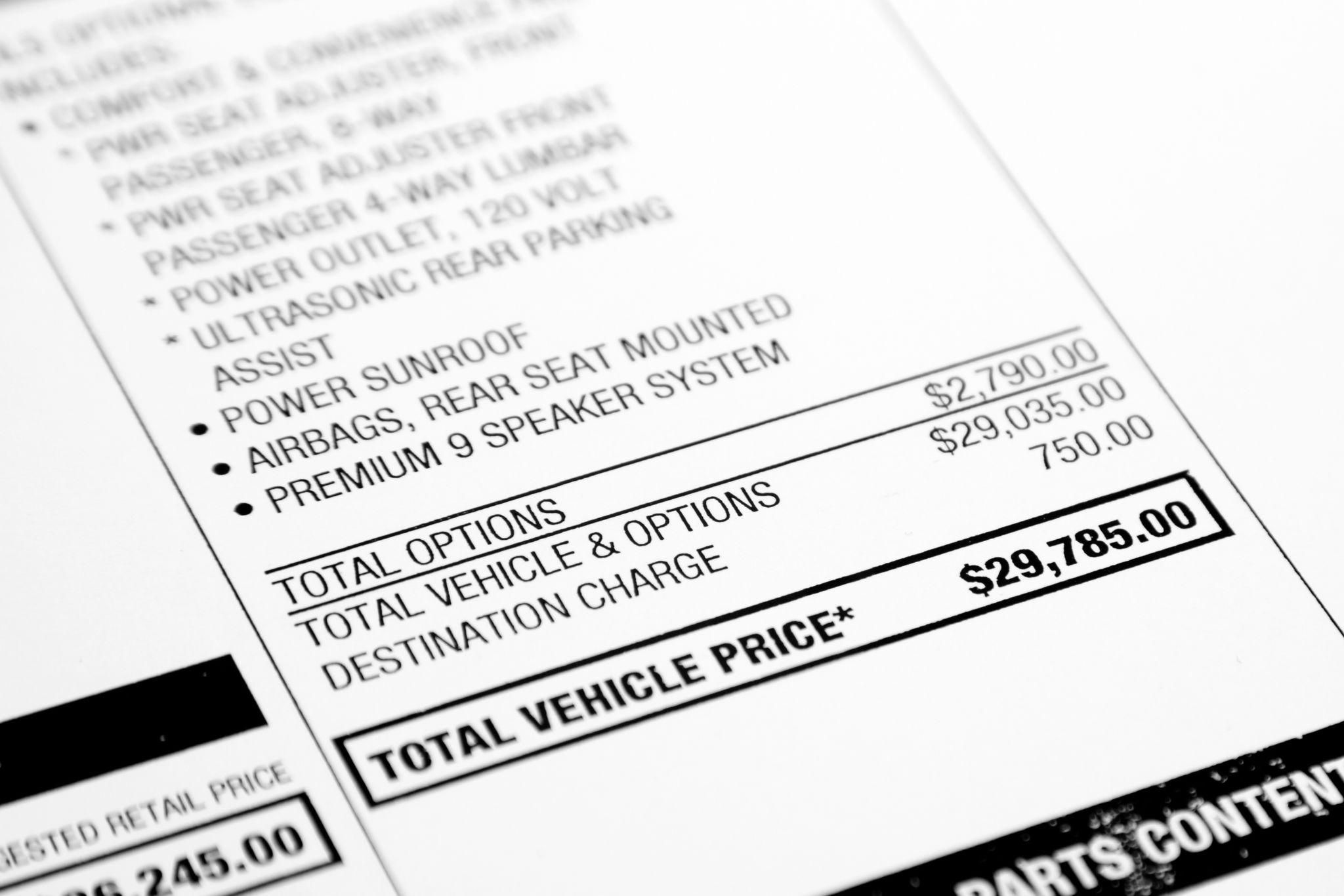

Plain and simple, there's a sticker on the car window that shows a “Total Vehicle Price”. This is the price of the car with standard features and options. The sticker you see was coined the “Monroney sticker”, for Senator Mike Monroney who helped pass the Automobile Information Disclosure Act of 1958, a federal law prohibiting the label from being removed or altered before the sale of a consumer.

The sticker price is also known as the manufacturer's suggested retail price (MSRP), but it doesn't encompass everything. Not only does the Monroney sticker display the MSRP of every new car, but it also includes A sticker price is the vehicle's MSRP (the factory set price), but it also includes every standard and optional feature, along with the destination charge. The sticker price does not include:

- State and federal taxes

- Title and Registration fees: Every state requires drivers to register their newly purchased vehicle, and it includes title, registration, and license plates. Dealers may offer to do this for you, and they typically mark up that price for the service.

- Documentation fees: the cost of handling and processing dealer paperwork related to the sale. Most dealerships pass some of this cost onto the buyer.

- Dealer surcharges

- Dealer added accessories

The sticker price will never show what is known as the “invoice price” of a car, which is the price the dealer pays the manufacturer to have that car in its inventory. But even that invoice price does not include what's known as “dealer holdback”, which is defined as is an amount of money paid to a car dealership from the car manufacturer on each new vehicle they end up selling to a customer. This amount can range from 1-3% of the MSRP. So, for example, if you buy a 2024 Mazda CX-5 2.5 Turbo Premium for $37,800, the dealer could get as much as $1,134 directly from Mazda. So, when the dealer says they're not making any money off you if they charge only the invoice price, that's not accurate.

Most dealerships will typically not sell you a car for less than the sticker price, especially when a vehicle is highly desirable. They may even mark up the vehicle above the MSRP and add that mark-up to the purchase price of the vehicle.

Dealer Mark-Up

(photo: Lincoln)

(photo: Lincoln)The aforementioned markup does not equate to the MSRP. The dealer can sometimes mark up (with the permission of the manufacturer) the price, largely determined by the demand for that particular model. For instance, if there's a car that's considered hot and in demand (like the new 2025 Lincoln Nautilus, above), then it's probable that a dealership would take advantage of that and raise their prices. The manufacturer either has to approve that or turn a blind eye to the practice in order for the dealership(s) to get away with it. On the flipside, if there's a car model that's sitting on dealer lots for months, it's unlikely that there will be any markup because they need to sell the vehicle. The longer it sits on the lot, the more it costs for them to maintain it.

The good news is that the average new vehicle price is coming down, up from a colossal high of just over $50,000 in 2023. Now, it's around $48,000. By comparison, it was about $40,000 back in 2020. Due to the impact of COVID on the supply chain (especially the microprocessor chip supply), new vehicles were not being produced at the same rate as customers and dealers were accustomed do, driving prices up sharply. Markups abounded in the industry then.

In addition to a vehicle's demand, the average markup is impacted by the segment of the vehicle. Trucks are in more demand than hatchbacks. SUVs are crossovers are more desirable to carbuyers than sedans and coupes. Know what you want to buy and understand how that will impact the price of the vehicle you want. If the markups are too much, then consider a different segment or model that will still suit your needs. If you don't have to have the latest and greatest, try to be flexible and it could save you quite a bit of money.

How to Negotiate

Unless you're a masochist, nobody likes negotiating with a car salesperson. Some make it easy by saying you pay the sticker price, no more and no less. But if you're looking to save a little bit of money, prepare to use some important tactics that don't ask for an insanely low price that the dealership would never agree to. If you absolutely loathe going to the dealership for the entire buying experienc, some dealerships no longer even entertain negotiation and you can buy your car online. Hyundai's Click-to-Buy program allows you to do just that.

But if you insist on “kicking the tires” and you want to do it all in person, visit the dealership on a slow weekday near the end of the month and near the end of the quarter. Dealers have to meet quota and have more wiggle room during these times. Research the true market value of the car before going in to buy. Understand what people are paying for the car you want. Prepare to negotiate for 3 to 5 percent over the dealer cost. You can visit Kelley Blue Book, Consumer Reports, and Edmund's True Market Value to find the invoice price. Let the salesperson throw the price out first before you do, and then you can work at the negotiation from there.

Educated negotiation shows the dealer you've done your research and you're not just asking for a low price. You recognize that they need to make money, and you're not lowballing them. Don't go based on the monthly payment, something that they'll push you to look at. They will try to extend the length of the loan to bring down the price, and that's a false picture. You'll end up paying more in interest over the life of the loan. Focus on the out-the-door purchase price.

- Research the vehicle you want on the manufacturer's official website.

- Narrow down the trim and options you want and get a quote online or view available inventory in your area.

- Get pre-approved financing so you're in a position to show you're financially sound.

- Visit the dealership at the end of the month on a weekday.

- Ask if there are any available deals or incentives.

- Test drive the car you want.

- Review the Monroney sticker thoroughly and ask for clarification on any obscure charges. If there's a markup on top of the sticker price, consider going elsewhere.

- Prepare to negotiate and leave if the answer is no. Leave your name and number and tell them to call you if they change their minds.